The Global Equity Market Reactions of the Oil & Gas Midstream and Marine Shipping Industries to COVID-19: An Entropy Analysis

The Global Equity Market Reactions of the Oil & Gas Midstream and Marine Shipping Industries to COVID-19: An Entropy Analysis

Abstract

Keywords

References

Hsiang, S., Allen, D., Annan-Phan, S., Bell, K., Bolliger, I., Chong, T., Druckenmiller, H., Huang, L. Y., Hultgren, A., Krasovich, E., Lau, P., Lee, J., Rolf, E., Tseng, J., & Wu, T. (2020). The effect of large-scale anti-contagion policies on the COVID-19 pandemic. Nature, 584(7820), 262–267. doi:10.1038/s41586-020-2404-8.

Chinazzi, M., Davis, J. T., Ajelli, M., Gioannini, C., Litvinova, M., Merler, S., Pastore y Piontti, A., Mu, K., Rossi, L., Sun, K., Viboud, C., Xiong, X., Yu, H., Elizabeth Halloran, M., Longini, I. M., & Vespignani, A. (2020). The effect of travel restrictions on the spread of the 2019 novel coronavirus (COVID-19) outbreak. Science, 368(6489), 395–400. doi:10.1126/science.aba9757.

Guan, D., Wang, D., Hallegatte, S., Davis, S. J., Huo, J., Li, S., Bai, Y., Lei, T., Xue, Q., Coffman, D. M., Cheng, D., Chen, P., Liang, X., Xu, B., Lu, X., Wang, S., Hubacek, K., & Gong, P. (2020). Global supply-chain effects of COVID-19 control measures. Nature Human Behaviour, 4(6), 577–587. doi:10.1038/s41562-020-0896-8.

Hayakawa, K., & Mukunoki, H. (2021). The impact of COVID-19 on international trade: Evidence from the first shock. Journal of the Japanese and International Economies, 60, 101135. doi:10.1016/j.jjie.2021.101135.

Kamal, M. R., Chowdhury, M. A. F., & Hosain, M. M. (2021). Stock market reactions of maritime shipping industry in the time of COVID-19 pandemic crisis: an empirical investigation. Maritime Policy and Management. doi:10.1080/03088839.2021.1954255.

Xu, Y., Li, J. P., Chu, C. C., & Dinca, G. (2021). Impact of COVID-19 on transportation and logistics: a case of China. In Economic Research-Ekonomska Istrazivanja . doi:10.1080/1331677X.2021.1947339.

Yazır, D., Şahin, B., Yip, T. L., & Tseng, P. H. (2020). Effects of COVID-19 on maritime industry: a review. International Maritime Health, 71(4), 253–264. doi:10.5603/IMH.2020.0044.

Docherty, I., Marsden, G., Anable, J., & Forth, T. (2021). Transport, the economy and environmental sustainability post-Covid-19. Productivity and the Pandemic, 147–159. doi:10.4337/9781800374607.00017.

Ivanov, D., & Das, A. (2020). Coronavirus (COVID-19/SARS-CoV-2) and supply chain resilience: A research note. International Journal of Integrated Supply Management, 13(1), 90–102. doi:10.1504/IJISM.2020.107780.

Verschuur, J., Koks, E. E., & Hall, J. W. (2021). Global economic impacts of COVID-19 lockdown measures stand out in highfrequency shipping data. PLoS ONE, 16(4 April), 248818. doi:10.1371/journal.pone.0248818.

Golmohammadi, S., & Fazelabdolabadi, B. (2021). COVID-19: A game-changer to equity markets? Journal of Human, Earth and Future, 2(1), 46–81. doi: 10.28991/HEF-2021-02-01-05.

Harjoto, M. A., Rossi, F., Lee, R., & Sergi, B. S. (2021). How do equity markets react to COVID-19? Evidence from emerging and developed countries. Journal of Economics and Business, 115. doi:10.1016/j.jeconbus.2020.105966.

Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 36. doi:10.1016/j.frl.2020.101528.

Singh, A. (2020). COVID-19 and safer investment bets. Finance Research Letters, 36. doi:10.1016/j.frl.2020.101729.

Baig, A. S., & Chen, M. (2021). Did the COVID-19 pandemic (really) positively impact the IPO Market? An Analysis of information uncertainty. Finance Research Letters, 102372. doi:10.1016/j.frl.2021.102372.

JEBABLI, I., KOUAISSAH, N., & AROURI, M. (2021). Volatility Spillovers between Stock and Energy Markets during Crises: A Comparative Assessment between the 2008 Global Financial Crisis and the Covid-19 Pandemic Crisis. Finance Research Letters, 102363. doi:10.1016/j.frl.2021.102363.

Yu, X., Xiao, K., & Liu, J. (2021). Dynamic co-movements of COVID-19 pandemic anxieties and stock market returns. Finance Research Letters, 102219. doi:10.1016/j.frl.2021.102219.

Xu, L. (2021). Stock Return and the COVID-19 pandemic: Evidence from Canada and the US. Finance Research Letters, 38. doi:10.1016/j.frl.2020.101872.

Fry-McKibbin, R., Greenwood-Nimmo, M., Hsiao, C. Y. L., & Qi, L. (2021). Higher-order comoment contagion among G20 equity markets during the COVID-19 pandemic. Finance Research Letters, 102150. doi:10.1016/j.frl.2021.102150.

Amar, A. Ben, Belaid, F., Youssef, A. Ben, Chiao, B., & Guesmi, K. (2021). The unprecedented reaction of equity and commodity markets to COVID-19. Finance Research Letters, 38. doi:10.1016/j.frl.2020.101853.

Benlagha, N., & Omari, S. El. (2021). Connectedness of stock markets with gold and oil: New evidence from COVID-19 pandemic. Finance Research Letters, 102373. doi:10.1016/j.frl.2021.102373.

Bakry, W., Kavalmthara, P. J., Saverimuttu, V., Liu, Y., & Cyril, S. (2021). Response of stock market volatility to COVID-19 announcements and stringency measures: A comparison of developed and emerging markets. Finance Research Letters, 102350. doi:10.1016/j.frl.2021.102350.

Liu, Y., Wei, Y., Wang, Q., & Liu, Y. (2021). International stock market risk contagion during the COVID-19 pandemic. Finance Research Letters, 102145. doi:10.1016/j.frl.2021.102145.

Szczygielski, J. J., Bwanya, P. R., Charteris, A., & Brzeszczyński, J. (2021). The only certainty is uncertainty: An analysis of the impact of COVID-19 uncertainty on regional stock markets. Finance Research Letters, 43. doi:10.1016/j.frl.2021.101945.

Yarovaya, L., Elsayed, A. H., & Hammoudeh, S. (2021). Determinants of Spillovers between Islamic and Conventional Financial Markets: Exploring the Safe Haven Assets during the COVID-19 Pandemic. Finance Research Letters, 43. doi:10.1016/j.frl.2021.101979.

Carter, D., Mazumder, S., Simkins, B., & Sisneros, E. (2021). The stock price reaction of the COVID-19 pandemic on the airline, hotel, and tourism industries. Finance Research Letters, 102047. doi:10.1016/j.frl.2021.102047.

Buszko, M., Orzeszko, W., & Stawarz, M. (2021). COVID-19 pandemic and stability of stock market-A sectoral approach. PLoS ONE, 16(5 May), 250938. doi:10.1371/journal.pone.0250938.

He, P., Sun, Y., Zhang, Y., & Li, T. (2020). COVID–19’s Impact on Stock Prices across Different Sectors—an Event Study based on the Chinese Stock Market. Emerging Markets Finance and Trade, 56(10), 2198–2212. doi:10.1080/1540496X.2020.1785865.

Sayed, O. A., & Eledum, H. (2021). The short-run response of Saudi Arabia stock market to the outbreak of COVID-19 pandemic: An event-study methodology. International Journal of Finance and Economics, 1–15. doi:10.1002/ijfe.2539.

Alam, M. M., Wei, H., & Wahid, A. N. M. (2021). COVID-19 outbreak and sectoral performance of the Australian stock market: An event study analysis. Australian Economic Papers, 60(3), 482–495. doi:10.1111/1467-8454.12215.

Zoungrana, T. D., Toé, D. L. tan, & Toé, M. (2021). Covid-19 outbreak and stocks return on the West African Economic and Monetary Union’s stock market: An empirical analysis of the relationship through the event study approach. International Journal of Finance and Economics. doi:10.1002/ijfe.2484.

Bissoondoyal-Bheenick, E., Do, H., Hu, X., & Zhong, A. (2021). Learning from SARS: Return and volatility connectedness in COVID-19. Finance Research Letters, 41. doi:10.1016/j.frl.2020.101796.

Castillo, B., León, Á., & Ñíguez, T. M. (2021). Backtesting VaR under the COVID-19 sudden changes in volatility. Finance Research Letters, 43. doi:10.1016/j.frl.2021.102024.

Engelhardt, N., Krause, M., Neukirchen, D., & Posch, P. N. (2021). Trust and stock market volatility during the COVID-19 crisis. Finance Research Letters, 38. doi:10.1016/j.frl.2020.101873.

Salman, A., & Ali, Q. (2021). Covid-19 and its impact on the stock market in GCC. Journal of Sustainable Finance and Investment. doi:10.1080/20430795.2021.1944036.

Bannigidadmath, D., Narayan, P. K., Phan, D. H. B., & Gong, Q. (2021). How stock markets reacted to COVID-19? Evidence from 25 countries. Finance Research Letters, 102161. doi:10.1016/j.frl.2021.102161.

Yao, C. Z., & Li, H. Y. (2020). Effective Transfer Entropy Approach to Information Flow among EPU, Investor Sentiment and Stock Market. Frontiers in Physics, 8. doi:10.3389/fphy.2020.00206.

Sensoy, A., Sobaci, C., Sensoy, S., & Alali, F. (2014). Effective transfer entropy approach to information flow between exchange rates and stock markets. Chaos, Solitons and Fractals, 68, 180–185. doi:10.1016/j.chaos.2014.08.007.

Škrinjarić, T., Quintino, D., & Ferreira, P. (2021). Transfer Entropy Approach for Portfolio Optimization: An Empirical Approach for CESEE Markets. Journal of Risk and Financial Management, 14(8), 369. doi:10.3390/jrfm14080369.

Schreiber, T. (2000). Measuring information transfer. Physical Review Letters, 85(2), 461–464. doi:10.1103/PhysRevLett.85.461.

Liu, A., Chen, J., Yang, S. Y., & Hawkes, A. G. (2020). The flow of information in trading: An entropy approach to market regimes. Entropy, 22(9), 1064. doi:10.3390/E22091064.

Osei, P. M., & Adam, A. M. (2020). Quantifying the Information Flow between Ghana Stock Market Index and Its Constituents Using Transfer Entropy. In Mathematical Problems in Engineering (Vol. 2020). doi:10.1155/2020/6183421.

Marschinski, R., & Kantz, H. (2002). Analysing the information flow between financial time series. The European Physical Journal B, 30(2), 275–281. doi:10.1140/epjb/e2002-00379-2.

Lahmiri, S., & Bekiros, S. (2020). Renyi entropy and mutual information measurement of market expectations and investor fear during the COVID-19 pandemic. Chaos, Solitons and Fractals, 139, 110084. doi:10.1016/j.chaos.2020.110084.

Article

A company involved in

- 10 July 2019

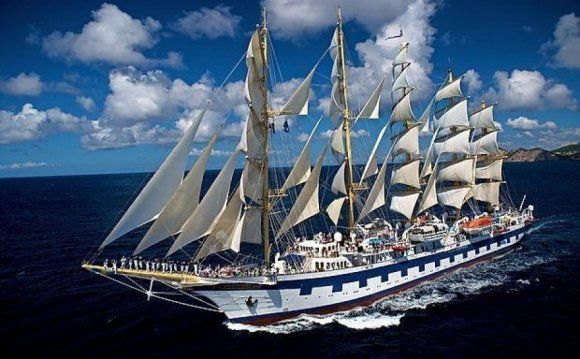

Top Ten Shipping Companies

- 10 July 2019

What Is Ship Breaking?

- 10 July 2019

Ocean Freight and Shipping

- 10 July 2019

Top Ten Shipping Companies

- 10 July 2019

Contacts

- Unit 1, 3rd floor, No.7, Azizollahi, Mirzaye Shirazi, Tehran, Iran.

- +98-21-88930056-69

- info@pacificline.co

Working Hours

10:00 AM - 6:00 PM

10:00 AM - 6:00 PM

10:00 AM - 6:00 PM

10:00 AM - 6:00 PM

10:00 AM - 6:00 PM

10:00 AM - 6:00 PM

Closed